Methods and concepts for Value Based Management (VBM)

Relative Value of Growth

The Relative Value of Growth (RVG) method from Mass is a technique that can be used for

comparing how growth- and margin improvements effect shareholder value creation.

RVG expresses the value of an extra percentage point of growth as a multiple of the value of a percentage

point increase in a company's operating profit margin. The higher the multiple, the more valuable growth is

to a company.

The Relative Value of Growth (RVG) method from Mass is a technique that can be used for

comparing how growth- and margin improvements effect shareholder value creation.

RVG expresses the value of an extra percentage point of growth as a multiple of the value of a percentage

point increase in a company's operating profit margin. The higher the multiple, the more valuable growth is

to a company.

An RVG of 3, for example, means that a firm would generate three times as much shareholder value from

adding 1% of growth than it would from increasing operating profit by 1%.

Mass claims that the shareholder value creation potential of growth strategies often outweighs

that of cost cutting strategies by a factor. In his article in HBR of April 2005, Mass concludes furthermore

that growth is often far more valuable than managers think, especially when considering long-term.

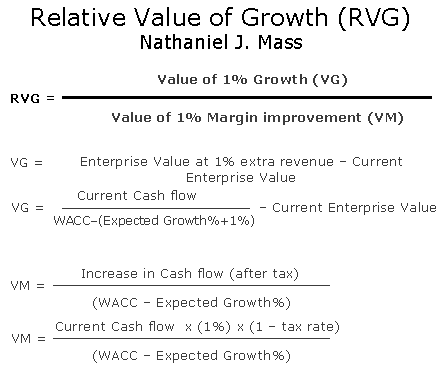

Calculation of the Relative Value of Growth. Formula

RCG is calculated by dividing the value of 1% revenue growth by the value of 1% margin improvement (see

fig).

The Relative Value of Growth model can be used for making investing decisions, corporate strategy

formulation, business strategy formulation, establishing a long-term focus, show the potential of growth as a

source of value, understanding shareholders expectations, performance management and executive

compensation.

The main strengths of the RVG framework are it helps to find the right balance between growth and

margin improvement at corporate and SBU level, to establish a long-term investing focus, to show the

potential of growth as a source of value, to provide managers with an understanding what shareholders

expect of them. It may also prove useful for performance management and executive compensation. It's

relatively easy to use.

The main limitations of the Relative Value of Growth method are:

- Margin calculation is EBIT / Operating Profit-Based: limited reliability and can be relatively easy manipulated.

- Technically flawed and not very precise

- DCF model does not distinguishes short-term and long-term

- Cost of capital and growth-return prospects are taken at corporate level

- No distinction made between acquisition-driven growth and organic growth

- RVG is a relative measure: does not show the actual amount of the contribution of growth and margin improvement.

- Although TVG helps shifting the investment focus to the long term, it does not actually prevent analysts or investors from taking a short-term view.

- Intangibles valuation?