Corporate Restructuring

Strategic, organisational or financial restructuring is the answer in business situations with cash shortage and decline of operational business results.

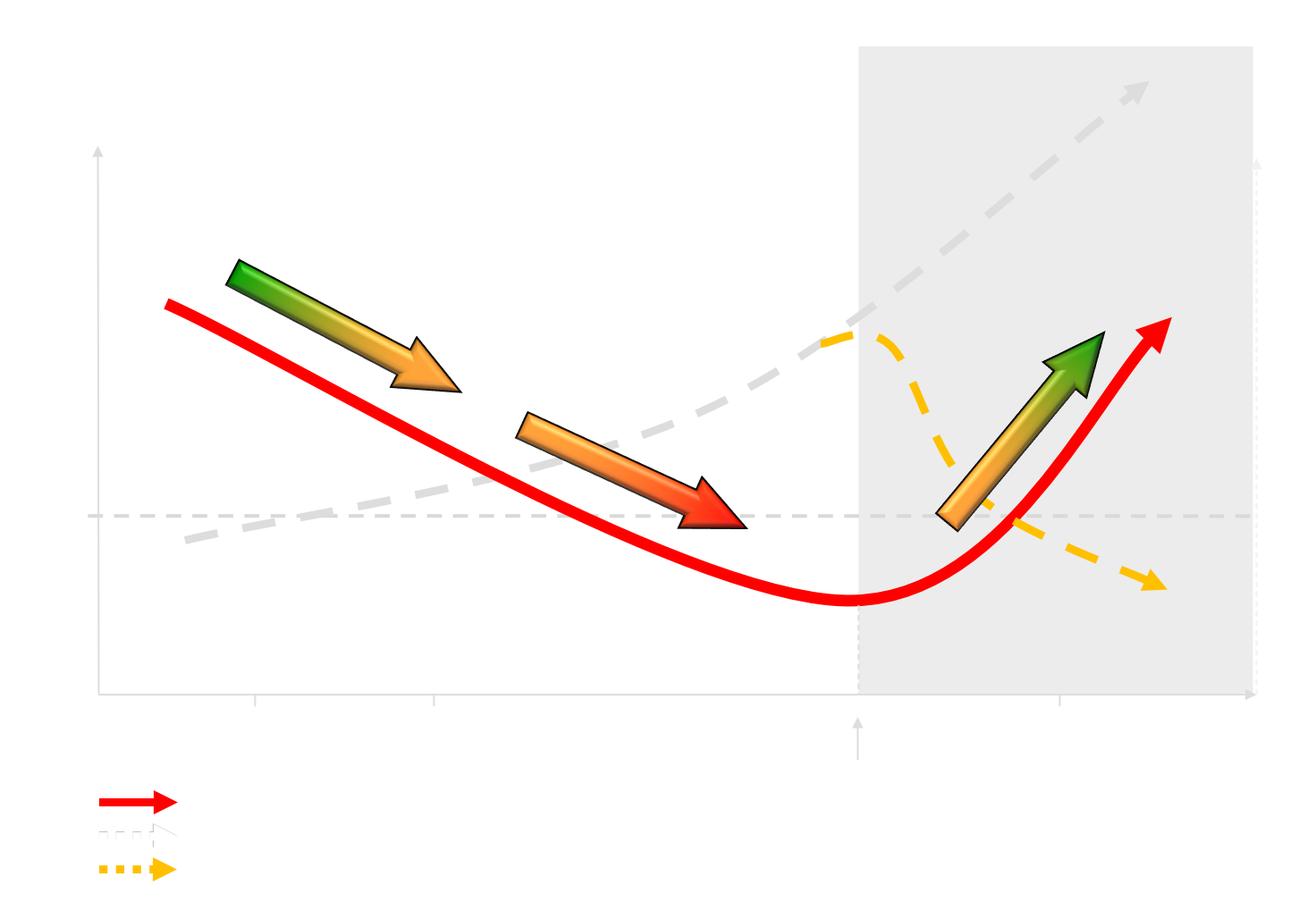

What you see is a decline of the profitability (loss) and a cash position that becomes under pressure. There is an increasing need for additional funding and financing. What should be done is a short term scenario planning in which concrete measures should be defined to improve this situation quickly. Cash is King ! Our stepwise approach:

Step 1: Analyze current situation

Strategy and Business Model

- company legal structure;

- visioning & objectives of the company and the shareholders;

- match the current strategy with the constraints of the (global) market development and the positioning of the companies PMC’s;

- check the strategic approach to realize the defined business objectives;

- analyses of the growth strategy;

- analyses of the used business model(s);

- etc.;

Organization, management, procedures, tools and methods

- organizational structure, methods, staff & management model of the company;

- planning & control procedures & instruments;

- financial organization, administrative processes, accounting standards and internal controls;

- a vision about the efficiency and management of business processes;

- evaluation of measurements to assure the reliability of the management information (internally and for financial stakeholders);

- used (ICT) tools and systems;

- working capital management and cash management;

- etc.;

Financial performance

- analyses of the composition and quality of the turnover and breakdown of the margins/financial results;

- analyses of the current financial situation (business results and cash position);

- analyses of the forecasts and estimates of the company;

- analyses of the latest estimates of the company;

- analyses of the working capital and cash position (stock positions, account receivables, account payables);

- analyses of the capital and financing structure of the company;

- etc.;

Step 2: Detect improvement opportunities (read more)

Cost cutting measures, reduce cash out flow, reduce stock positions, performance improvement measures, add risk bearing capital, financial restructuring, stop business activities with low or negative contribution to business results, stop investments, sell and lease back of fixed assets, improve cash management, build strategic alliances, sell non core activities, implement lean and mean business model, make arrangements with creditors, etc. ;

Step 3: Scenario analyses

Calculate effects of improvement opportunities in Balance Sheet, Profit & Loss Account and Cash Prognoses;

Step 4: Choose scenario with financial stakeholders (shareholders, banks, etc.)

Step 5: Implementation of restructuring measures

Step 6: Monitor results (read more)

Steps Ahead... uses proven and practical methods to realize quick results against the strategical company background. In close cooperation with the management and financial stakeholders of the company we are able to quickly improve your operational results and cash position. And bring back your financial stakeholders in their comfort zone...

Read more about: